Systemic Necessity and Exit Value

Across regulated infrastructure, exit value is rarely created at the moment of sale. It is accumulated, quietly, through years of decisions that reduce uncertainty, preserve confidence, and keep future options open. In the UK water sector, that accumulation increasingly depends on whether asset understanding can survive scrutiny by parties who were not involved in building it.

The recent wave of Ofwat enforcement has made this explicit. Asset visibility, evidence quality, and governance are no longer operational concerns alone. They are systemic requirements that shape how utilities are valued, financed, and transferred. What was once treated as internal assurance infrastructure is now part of the external trust framework against which companies are judged.

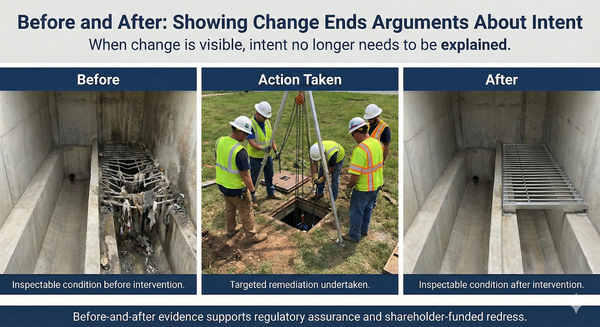

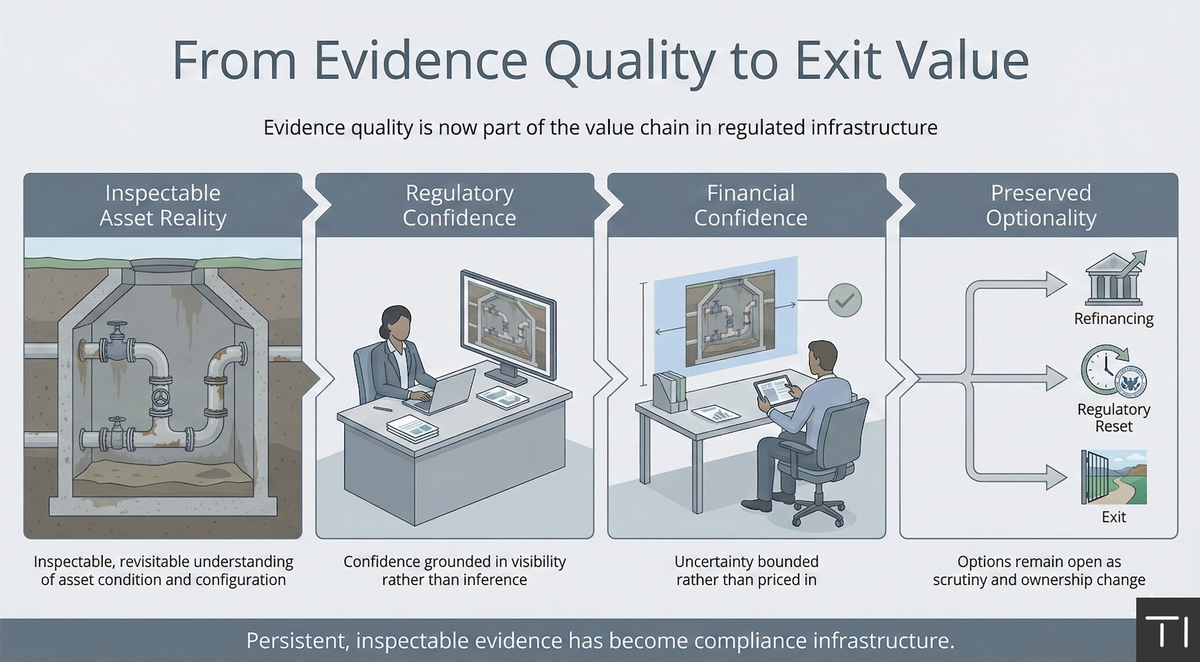

From an ownership and exit perspective, the distinction that matters is not between old and new assets, or between sophisticated and basic systems. It is between evidence that can be transferred and evidence that cannot. Transferable evidence is inspectable, revisitable, and intelligible to third parties. Non-transferable evidence relies on explanation, institutional memory, or narrative continuity. Under scrutiny, the latter degrades quickly.

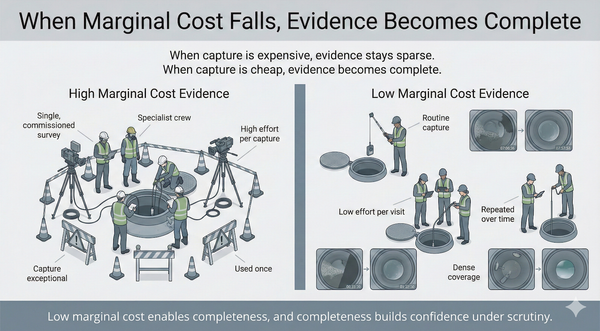

This is why evidence quality now affects asset value more than asset age. Two companies with similar networks and similar investment histories can face very different outcomes during diligence. Where asset condition, configuration, and risk exposure can be inspected directly, uncertainty is bounded. Where it cannot, uncertainty is priced in. Buffers grow, assumptions harden, and valuation adjusts accordingly. This is not punitive behaviour. It is rational risk management.

Due diligence makes this visible. It functions as a stress test for evidence, not intent. Static reports, summaries, and assurances that work well internally often collapse when challenged by new owners, lenders, or regulators. What survives is evidence that can stand without explanation. Inspectable context allows reviewers to test assumptions for themselves, reducing reliance on trust in process or people.

The financial consequences follow predictable patterns. Uncertainty that cannot be resolved is not debated away. It is converted into haircuts, conservative assumptions, and delayed transactions. Optionality narrows as unresolved questions accumulate. Conversely, when evidence can be revisited and reused as circumstances change, optionality is preserved. Refinancing becomes easier. Regulatory resets become less disruptive. Exit pathways remain open for longer.

This is where the concept of revisitable evidence becomes strategically important. Evidence that retains its value over time, across organisational boundaries, and under changing expectations is not just an engineering artefact. It is a financial asset. It supports confidence during moments of transition, when new parties must make decisions quickly and defensibly.

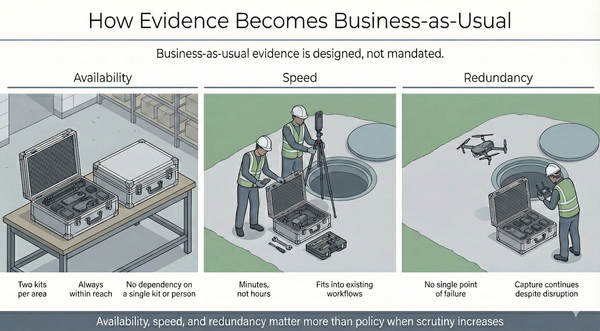

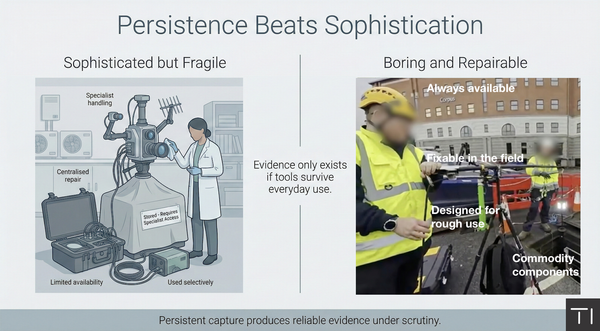

In this context, platforms that embed evidence capture and visibility into business-as-usual operations take on a different character. They are no longer tools for improving insight in isolation. They become part of the compliance infrastructure that underpins trust in regulated systems. Their value lies in persistence and scalability, not novelty.

This is the position Trace Intercept occupies. By enabling evidence that is inspectable, transferable, and persistent, it aligns directly with the pressures shaping exit value in UK water. The platform is not dependent on a single regulatory cycle, ownership structure, or management team. It produces evidence that can be carried forward, interrogated again, and reused as scrutiny evolves.

For potential acquirers, this matters. Platforms that reduce uncertainty across multiple regulated entities, and that can be scaled consistently, are attractive precisely because they address systemic risk rather than isolated use cases. They support compliance, governance, and valuation simultaneously. They turn a fragmented evidential landscape into something more legible and defensible.

The convergence of regulatory enforcement, capital scrutiny, and governance expectation has created a new baseline. Asset visibility is no longer a differentiator. It is a necessity. Companies that treat evidence as a persistent, transferable asset are better positioned to navigate this environment. Those that do not will continue to see value eroded through mechanisms that feel external, but are rooted in internal visibility gaps.

Exit value in regulated infrastructure is ultimately about confidence under change. Evidence that can survive that change, and that can be scaled across asset bases, is now part of the core infrastructure of the sector.