Revisitable Evidence Preserves Optionality

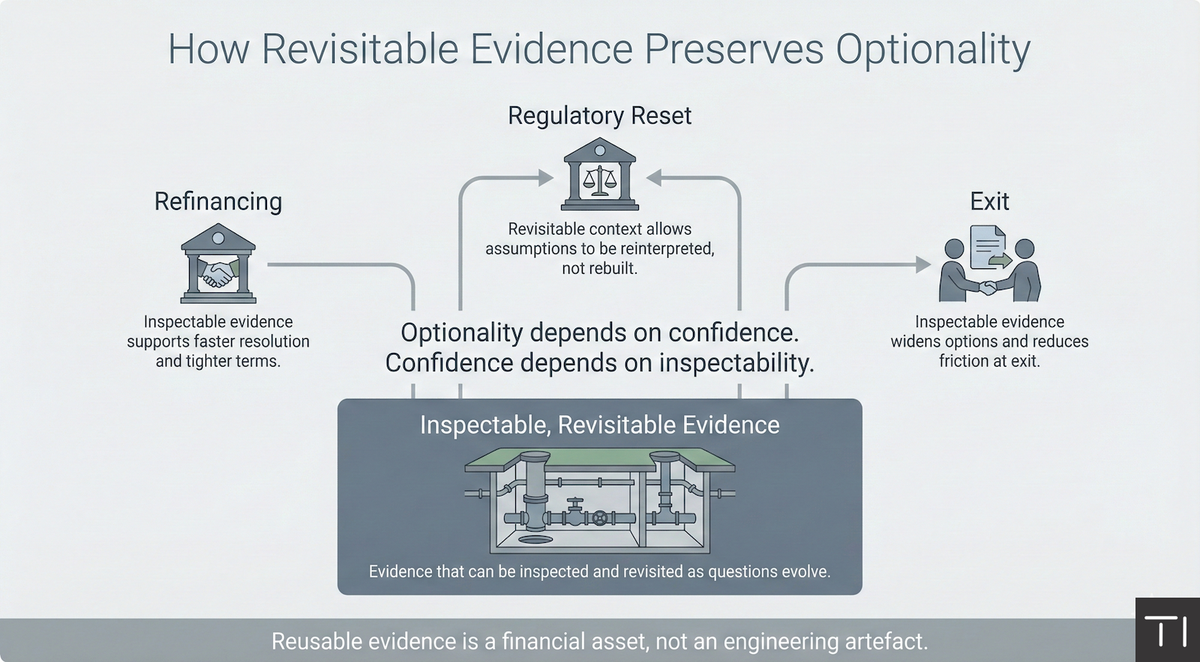

In infrastructure ownership, optionality is often discussed in abstract terms. The ability to refinance, restructure, exit, or adapt to regulatory change is treated as a function of market conditions and timing. In practice, optionality depends on something more prosaic: confidence. And confidence depends on whether the reality of the asset base can be inspected when it matters.

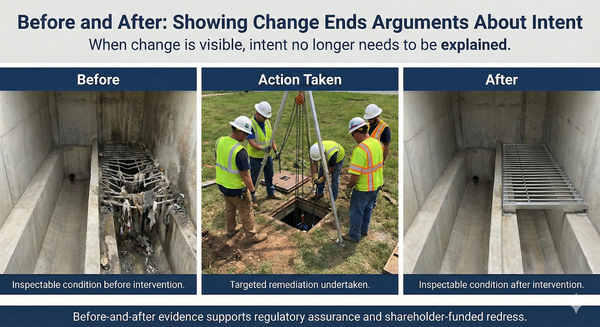

Exit events, refinancing rounds, and regulatory resets all share a common feature. They introduce external scrutiny under time pressure. New parties are asked to form judgements quickly about condition, risk, and future exposure. In those moments, confidence is not built through explanation. It is built through evidence that can be inspected, revisited, and understood without reliance on institutional memory.

This is where revisitable evidence becomes critical. Evidence that exists only as a snapshot in a report or as knowledge held by individuals does not travel well across ownership boundaries or governance changes. When the people who generated the evidence are no longer present, or when the audience changes, confidence degrades. Optionality narrows accordingly.

Refinancing provides a clear example. Lenders reassess risk based on their ability to bound uncertainty. When evidence of asset condition, access constraints, or latent issues can be revisited directly, questions resolve faster and with less conservatism. When evidence is indirect or stale, buffers increase and terms tighten. The difference is not the underlying asset, but the confidence with which it can be evaluated.

Regulatory resets introduce a similar dynamic. Assumptions that were accepted in one period may be challenged in the next as expectations evolve. Assets that are well evidenced can be reinterpreted in light of new standards without starting from scratch. Assets supported only by historic summaries require revalidation, often through additional surveys and analysis. Optionality is consumed by the effort required to rebuild confidence.

Exit scenarios are the most acute stress test. Potential buyers have limited time and little tolerance for ambiguity. Evidence that can be inspected independently supports smoother transactions and broader interest. Evidence that cannot forces buyers to protect themselves through discounts, conditions, or delay. In some cases, it removes options entirely.

The common thread is inspectability. Confidence is not created by volume of documentation, but by the ability to revisit evidence as questions evolve. Inspectable evidence allows uncertainty to be bounded rather than imagined. It supports judgement by new parties who do not share the original context.

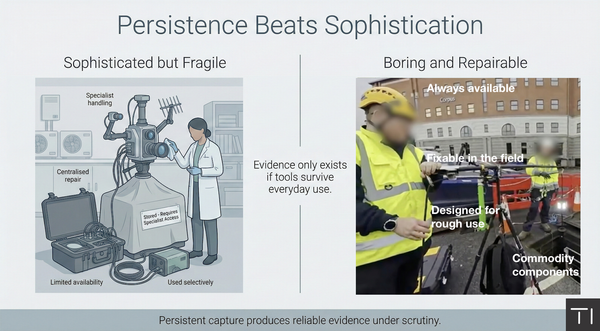

Inspectability, in turn, depends on how evidence is captured and preserved. Evidence that retains spatial, visual, and contextual richness is more likely to remain useful over time. Evidence that is compressed into summaries or tied to a single purpose degrades as circumstances change. The way evidence is handled early determines whether it remains an asset or becomes a liability later.

This has an important implication for how evidence is valued. Reusable, revisitable evidence should be treated as a financial asset, not just an engineering artefact. It preserves optionality by supporting confidence across ownership changes, regulatory cycles, and market events. It reduces the friction associated with scrutiny and keeps future pathways open.

Optionality is often lost quietly. It erodes through small concessions to uncertainty that accumulate over time. Revisitable evidence slows that erosion. It does not eliminate risk, but it keeps choices available. In a sector where ownership, regulation, and expectations continue to shift, that preservation of choice has real value.